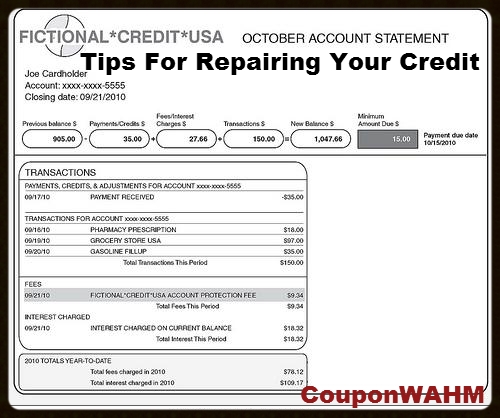

In some cases, bad credit is a result of irresponsible money management. But it often occurs because of unexpected financial hardship. One day you might have all of your bills current, and the next you could become disabled or lose your job. And if you fall behind on your debts, it will wreak havoc on your credit rating.

Credit repair agencies claim that they can remove bad entries from your credit report. But did you know that you can often have them removed yourself at a much lower cost? There are two methods by which you may be able to get negative entries removed from your report.

Option #1: File a Dispute with the Credit Bureaus

The Fair Credit Reporting Act (FCRA) requires credit bureaus to investigate any item on your credit report that you dispute. If the information is found to be false, inaccurate, or unverifiable, it must be corrected or removed from your report. The bureaus have 30 days from the time they receive notice of the dispute to complete their investigation.

If there is any inaccurate information on your credit report, a dispute is certainly in order. However some people have had luck disputing items that were accurate, including judgments, collections accounts, and repossessions. If such items are not verified by the creditor (or the court in the case of judgments) within the time limit for investigation, they must be removed.

If you decide to dispute a legitimate entry, simply write a letter to each of the credit bureaus stating that you dispute that entry. No explanation is required. But keep in mind that if the entry is verified, it will remain on your report. If the creditor verifies the information after the 30-day time limit, the credit bureau may reinstate the entry as long as they notify you at least 5 days before doing so.

Option #2: Negotiate with Creditors

Dealing with creditors can be intimidating, especially if you’re not on good terms with them. However, speaking to your creditors directly may help you get negative information removed from your credit report.

If you only have a late payment or two on your account, a creditor might be willing to remove the derogatory information once you’ve resumed a regular payment schedule. If you’ve experienced repossession or had an account turned over to collections, payment in full might persuade them to remove the negative entry. It sounds like a long shot, but you never know until you ask. Requests to remove late payment information may be made after you’ve brought your account current. But if you’re hoping for the removal of a repossession or collection action, it’s best to negotiate a deal before you pay anything.

What to do if You Can’t Get the Bad Entries Removed

No guarantee disputing information on your credit report or negotiating with creditors will get negative items removed from your record. If it doesn’t, the best thing you can do is try to build up some positive information on your report.

The first thing you need to do when trying to rebuild good credit is to bring past-due accounts current. Try to work out a deal with your creditors to accomplish this, or talk to a credit counseling agency. But don’t miss payments on current accounts to put money toward those that are past due. If it comes down to paying one or the other, keep the current account current.

Once you’ve brought all of your accounts current, put a priority on keeping them that way. Making your payments on schedule will raise your credit score, and with time, the good entries may outweigh the bad.